MARSH

Weighing the risks of the AI revolution

As emerging technologies appear almost overnight, Jaymin Kim assesses the risks from a mitigation and risk transfer perspective.

On 9 September, the legislation enacting the Australian climate-related disclosures regime was passed. The reporting standards that will apply are expected to be issued in the next month or so and consultation on how the assurance requirements will be phased in is expected to kick off at the same time. The first reporting year starts on 1 January 2025.

It is expected that sections of the first report will be subject to limited assurance. These sections go beyond scope 1 and scope 2 greenhouse gas (GHG) emissions disclosures to also include governance and the identified risks and opportunities.

It is suggested the whole report will have some level of assurance from the second year of reporting, including reasonable assurance over the scope 1 and scope 2 GHG emissions disclosures. And by the fourth report, the whole report will be subject to reasonable assurance.

This is an ambitious timeline and it could be said the New Zealand regime, which requires limited assurance over the GHG emissions disclosures from the second report, pales in comparison.

This is the theme of the Australian climate-reporting regime when compared to the New Zealand one – ‘same, same, but different’.

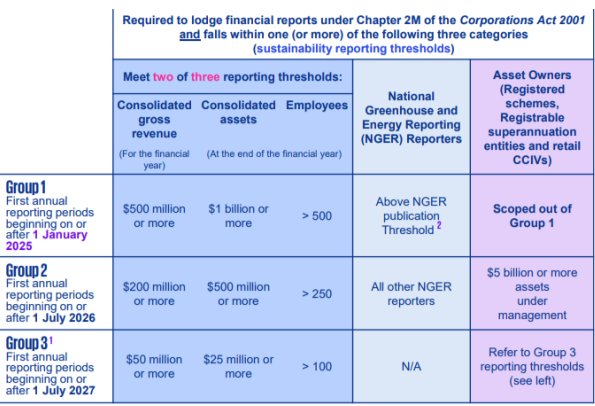

Apart from the significant difference in the regimes in respect of the assurance requirements, the other significant difference is the Australian regime will apply to a much bigger population of entities – down to entities with consolidated assets of A$25 million or more.

Interestingly, the Australian regime allows for the climate statement of ‘Group 3’ entities that assess they do not have material climate-related risks or opportunities to only include a statement to that effect, as well as an explanation of how it reached this conclusion. A directors’ declaration and auditor report will also be required. This is similar to an idea that was included in New Zealand’s draft legislation but ultimately rejected.

The rest, however, is pretty much like the New Zealand regime:

And last, but not least, the approach to enforcement.

In New Zealand, the Financial Markets Authority (FMA) stated it will be taking a broadly educative and constructive approach in the first few years, with an initial focus on issuing high-level guidance on compliance expectations and moving to a more proactive regulatory role as the regime becomes established. Any enforcement action will be considered on a case-by-case basis.

In Australia, the Australian Securities and Investments Commission (ASIC) advised it will take a pragmatic approach to the supervision and enforcement of the regime. In addition, a modified liability approach will apply to scope 3 emissions, scenario analysis and transition plans disclosures for three years, and to all forward-looking statements for the first financial year for ‘Group 1’ entities.

Even though the New Zealand regime has been in place for a year, most climate-reporting entities are only stepping into the trickier aspects now that they are moving into their year two reporting because of the first-time adoption provisions. So, climate-reporting entities may have opportunities to leverage broader networks and benefit from the developing thinking on both sides of the Tasman.

If you are a subsidiary of an Australian entity, the questions to raise proactively within your group is whether any group reporting would be required, and if so, the support that would be provided from the group. This will help you to understand the impact on your own resourcing in New Zealand.

But we expect the bigger impact to be on entities that are part of the value chain of the climate-reporting entities operating in either, or both, jurisdictions because there will be increasing demand for information about their GHG emissions. So, whether you are a climate-reporting entity or not, it will pay to think proactively about how best to approach and respond to these requests.

Follow these links for more information about the Australian regime and standards, and please contact us if you would like to discuss any of the matters raised in this article or specific details of the regimes.

For more details see, First Australian Sustainability Reporting Standards and Climate-related Financial Disclosures Legislation Passed.